Business Buyer Diaries: the Reality Before, During, and After

<p>Welcome to the Business Buyer Diaries. My name is Nathan Platter, I’m a full-time employee, and I bought a business! I did everything right from finding the deal, handling due diligence on 63 different opportunities, and ultimately buying a profitable gym, and boy was I in for a surprise as a new owner! I chronicle everything in real time, including the biggest wins to the stressful nights at 2am. I’m sharing my journey without sugarcoating anything, so you don’t repeat the same mistakes I do.</p>

<p>Join the Business Buyers Club! <br>

https://businessbuyersclub.com/memberships <br>

Enter code 070499</p>

<p>Learn Due Diligence for yourself! <br>

https://dealacademy.app.clientclub.net/courses/offers/75e59f69-9746-4b94-a6cd-562bcc9347d1 <br>

Enter code</p>

<p>SanterMedia, my goto Gym Marketing Agency <br>

https://go.santermedia.com/nathan <br>

Tell them Nathan sent you!</p>

Business Buyer Diaries: the Reality Before, During, and After

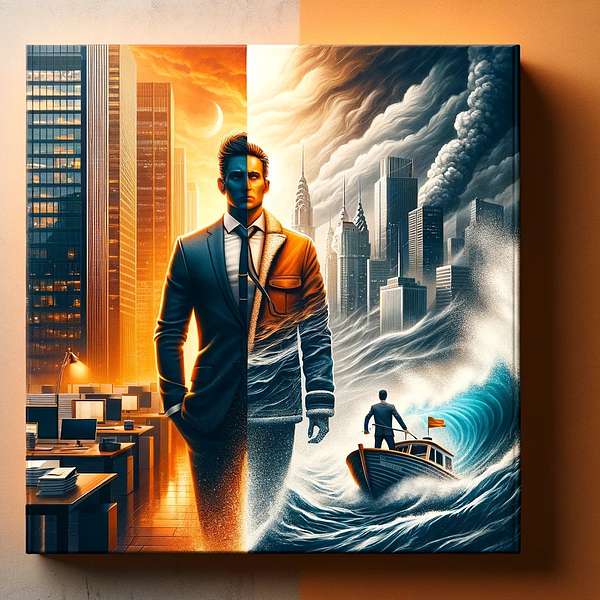

300. I have supernatural confidence and renewed faith. This entire story will work out for the good of everyone involved.

Throughout this episode, Nathan's candid reflections reveal an internal conflict between succumbing to financial pressures and finding innovative solutions to survive. He considers the possibility of launching a new venture to offset his losses, aiming for a win-win scenario where everyone, from his staff to his loyal members, emerges on top. Nathan's story is a testament to strategic thinking and unwavering optimism, offering valuable insights into the complex realities of sustaining a business in tough times. Listen as we unravel Nathan's journey, showcasing not just the obstacles he faces but the opportunities he envisions for a brighter future.

all right. Well, just had the weekly check-in and, oh man, my, my manager is just distraught. It's understand, understandably so. Um, it's she's. She's very good at owning her emotions and where she's at high highs, low lows, just like all of us, though I can tell it's it's taking a toll on her. And, um, she's one of those folks that, like, if she's not doing very well, you can tell like she cares. And it's hard for her to have a cheery go lucky day by day when in your head, like your job could be at stake in a few weeks and you have to go find work and I know I sound cheery and bubbly right now I should not be this optimistic.

Speaker 1:We've got several things going for the studio that leads me to be optimistic. Number one our expenses are in line with KPI. We're not overpaying on payroll, we're not overpaying on rent. We just have weird expenses that are keeping us above the red and I don't know why. But we're in line with a profitable studio. Second, we're fully staffed, fully managed. We have a team that is able to run the studio without an owner needing to be on site. Every other studio in our system has an owner on site throughout the day, so that is an absentee owner, is very applicable in our scenario. Number three we're only like two weeks late on our rent bill. Like we're not deep in a pit, like we are a pretty rescuable spot on that side of things. Number three we have the smallest churn rate in the whole system. We lose a member every three years and it's usually the folks that just joined the studio. We have a tiny churn rate.

Speaker 1:So if our members love the place, our staff love the place and overall as a business or absentee owner friendly, would it be crazy for a corporate to buy the studio from me and they owner up, absentee owner operated. They could rebrand it if they wanted to. They could keep it as my, the brand that I bought into. Would it be crazy for someone to step in rescue the business and then I have to get my personal finances figured out to afford the lease? Here's the thing. So let's pretend for a minute. I sell the studio back to corporate and now I swallow a $400,000 loss. I now have to come up with a $6,000, $7,000 a month payment, something like that, and then in a few months I have to start the seller financing note. I guess, um, is it possible? I could create or up level, like that's a lot of money, like that's like taking on a second job or like owning a small business level stuff. Is it possible I could create a business that generates 10K a month, take home pay, offset the losses of my SBA loan, and now we have the studio survives, the staff keeps their jobs, the members have a place to go, corporate keeps the positives.

Speaker 1:One of their shiny examples on the books I know Nathan has to do is go figure it out. Nathan has to go that route. Maybe that's the solution here. I don't know. The ego side of me wants to say oh, nathan needs to be the victim. Nathan needs to go down with the ship. Nathan needs to close the doors. Nathan needs to highlight that the sellers sold him a wonderful. When I say a wonderful business, I mean the substance of the business is good, but the financials are bad. They sold him a wonderful membership base, a wonderful location. Everything is good except the expenses and the revenue. Everything else is fantastic and that's excessively optimistic to say out loud. But that means there's an opportunity here. There is always an opportunity. The sun is shining.

Speaker 1:I read my Bible today. I should not be this joy-filled and I'm seeing that there's a way for everyone to win, and I do believe everyone. Corporate can win, members can win, staff can win. I can win Nessun Dorma, the final songs of that. What is it called? Aria, I don't know, it's in churro, in churro, very, very good song. At the end it's I Will Win, I Will Win, sung by Proverati, one of the most iconic, recognizable songs in the whole planet, and I don't even know Italian. But what this means is there is a shot, there is a way, there is a way to figure this out. I'm speaking it, I believe it, I really believe it, and I should not be believing it, but I believe it and I've got conviction that it can happen, and I should not have that level of conviction right now. And I believe there is a way I can keep my day job. I believe there's a way for the studio to survive I don't know how With me, without me, I don't know and there's a way to dig out of this monthly loss and no one loses, suffers or gets burned in the process. There's a way to do it. There's a way to do it. I have a couple ideas in my head. I don't know how, I don't know why let's talk with corporate.

Speaker 1:I'm zipping back from the studio. I want to be in person at least once a week because I want my staff to rely on me and if there's no spoken word that it's going to happen, I want them to know Nathan's going to be here for the Monday meeting or the Friday meeting, whatever meeting. If Nathan said he's going to be here, dang it. He's going to be here and I'm going to rely on that, even if there's no confirmation. I'm that guy. I do not let people down. I follow my word. I'm going to lean on God harder than everyone than I ever have before.

Speaker 1:I'm going to pray. I'm going to pray not in a position of weakness, but in a way of saying God, you said you would provide, you said you would intervene, you said you would make a way, and sometimes that means things fail, and that is an answer to prayer. And sometimes things don't fail, and that is also an answer to prayer. And I don't know when God chooses to do things, or why he chooses to do things, why he allows good things to happen, bad things to happen, but he allows just things to happen for his greater good, and I believe that. I believe God is a good God and no matter what happens, no matter the result of this, the input was with prayer and a unified family. The output is going to be prayer and a unified family.

Speaker 1:That is the ship I'm going to captain every day and right now it's a freaking hurricane and I don't know how to see straight, but I know how to look at my compass, I know how to rely on my instruments and I know how to stand tall when I'm getting slapped in the face with a Category 7 hurricane. And that's where we're in right now. That's where we're going, that's where we're at. That's where we're going. Let's rock and roll.